|

| Methodical Equity Fund Fact Sheet MDD |

|

| Where I Am? |

Home ==>

The Funds ==>

Methodical Equity Fund Fact Sheet MDD

|

|---|

|

The investment aim of this general equity unit trust is to provide investors with long-term capital growth at an average volatility through seeking to capture , by focusing, on equity selection opportunities.

|

| High | Avg. | Low |

| R 1.78 | R 0.89 | |

|

| Fund Sector |

|---|

| SA – Equity – General |

| Fund Maximum Annual Fee * |

|---|

0.92%-N

Y or N indicate if performance fee levied or not. Advisor fee excluded. |

| Distribution Periods |

|---|

| Bi-Annually |

|

| Launch Date |

|---|

| Jun 2016 |

9 years ago |

| Fund Benchmark |

|---|

| Sector Avg |

|

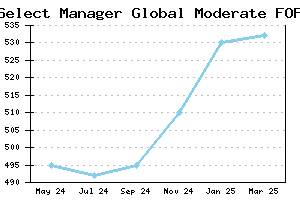

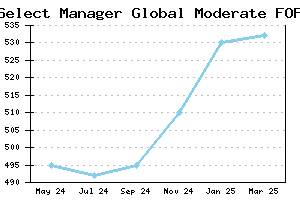

| Methodical Equity Fund Unit Prices |

|---|

|

|

|

|

As of 2023, the ownership of M&G Investments (prev. Prudential) is as follows:M&G Pls=50.12%; Staff=28.08%; Thesele Group=21.8% .

Ninety One overall assets under management are hovering around 3 trillion , that's almost the entire size of out unit trusts industry.

Met Collective Investments in it s heydays administered almost a quarter of all SA registered third party funds before it s consolidation with Momentum Investments after merger of Metropolitan and Momentum in 2017.

|

|

| Distributions Info (in cents) |

|---|

| Q2 of 2023 | 1.09 |

|---|

| Q4 of 2022 | 2.42 |

|---|

| Q2 of 2022 | 2.19 |

|---|

| | |

|---|

|

|

| Asset Allocation Analysis |

|---|

|

| BCI | Boutique |

| Collective Investments |

|

| Methodical |

| Investment Management |

|

|

|

| Please note that unit trusts investmets are generally classified as long-term investment products not suitable for trading and speculation. |

|