|

| Instit Managed Fund Fact Sheet MDD |

|

| Where I Am? |

Home ==>

The Funds ==>

Instit Managed Fund Fact Sheet MDD

|

|---|

|

This level 3 risk profiled fund main investment objective is to offer investors a moderate to high long term total return.

In order to meet its stated objective the fund will invest in equity securities , interest bearing securities ,real estate shares, money markets instruments and other forms of liquid assets.

|

| High | Avg. | Low |

| R 1.28 | R 1.25 | R 1.19 |

|

| Fund Sector |

|---|

| SA – Multi Asset – High Equity |

| Fund Maximum Annual Fee * |

|---|

0.58%-N

Y or N indicate if performance fee levied or not. Advisor fee excluded. |

| Distribution Periods |

|---|

| Bi-Annually |

|

| Launch Date |

|---|

| Oct 2014 |

11 years ago |

|

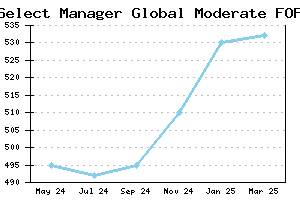

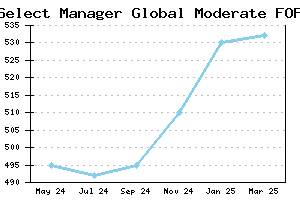

| Instit Managed Fund Unit Prices |

|---|

|

|

|

|

Alex Forbes entered the collective investments industry by acquiring the the asset manager Investment Solutions in late 2010s.

Sanlam Private Wealth acquired investment manager Brackenham in 2016. The firm was founded by Dave Boonzair , Andrew Hayes, and Maurice Koenis.

N-e-FG financial trading licence was revoked after funds were found missing . N-e-FG was founded by Corne Janse van Rensburg.

|

|

| Distributions Info (in cents) |

|---|

| | |

|---|

| Q4 of 2022 | 2.15 |

|---|

| Q2 of 2022 | 1.72 |

|---|

| | |

|---|

|

|

| Asset Allocation Analysis |

|---|

|

| BCI | Boutique |

| Collective Investments |

|

|

|

|

| Please note that unit trusts investmets are generally classified as long-term investment products not suitable for trading and speculation. |

|